Blog > VA Loan Sellers in Surprise AZ: What Happens to Your Entitlement After You Sell?

VA Loan Sellers in Surprise AZ: What Happens to Your Entitlement After You Sell?

by

VA Loan Sellers in Surprise AZ: What Happens to Your Entitlement After You Sell?

You're sitting at your kitchen table in Surprise, AZ, staring at those PCS orders that just turned your world upside down. The clock's ticking—you've got weeks, not months, to sell your VA-financed home before reporting to your next duty station.

And that nagging question won't leave you alone: What happens to my VA entitlement when I sell? Can I use it again at my next base?

You're scrolling through veteran forums at midnight, finding more questions than answers. Sound familiar? Here's the truth—your entitlement isn't lost forever. In fact, with the right game plan, you can reclaim it and make your sale surprisingly smooth. Let me show you exactly how.

What Is VA Loan Entitlement, Anyway?

Think of your VA loan entitlement as your service-earned superpower. It's the amount the Department of Veterans Affairs guarantees to lenders, giving you access to incredible benefits—no down payment, no PMI, and competitive rates that civilians can only dream about.

But here's where it gets tricky. When you sell your home, that entitlement doesn't automatically bounce back to you like a boomerang. Sometimes it stays tied to the property, leaving you wondering if you'll ever get to use this hard-earned benefit again. The answer? Absolutely—but you need to know the rules of the game.

Restoring Your Entitlement: The After-Sale Scoop

Here's what nobody tells you at the VA briefings: When you sell your home and completely pay off your VA loan, your entitlement typically gets restored in full. It's like hitting the reset button on your benefits.

But—and this is a big but—if that loan isn't fully paid off, or if someone assumes your loan without substituting their own VA entitlement, yours stays locked to that property like a ball and chain. For military families racing against PCS deadlines, this distinction can mean the difference between buying at your next station or scrambling for a rental.

The bottom line? Full payoff equals full restoration. It's that simple, yet that crucial.

VA Loan Assumptions: A Double-Edged Sword

Let's talk about the elephant in the room—VA loan assumptions. In today's market, where rates have climbed to 6% or higher, your 2.5% VA loan looks like pure gold to buyers. They're practically lining up to assume it, right?

Not so fast. Here's the reality check: If another veteran assumes your loan AND substitutes their entitlement for yours, you're golden. Your entitlement walks free. But if a civilian buyer takes over? Your entitlement stays handcuffed to that loan until they pay it off completely—which could take decades.

And here's what veterans are saying in 2025 forums: assumption processing is taking 30 to 90 days. When you've got three weeks to pack up your life and report to your next base, that timeline isn't just inconvenient—it's impossible. Want the full breakdown? Our guide on Who Can Assume Your VA Loan has all the details.

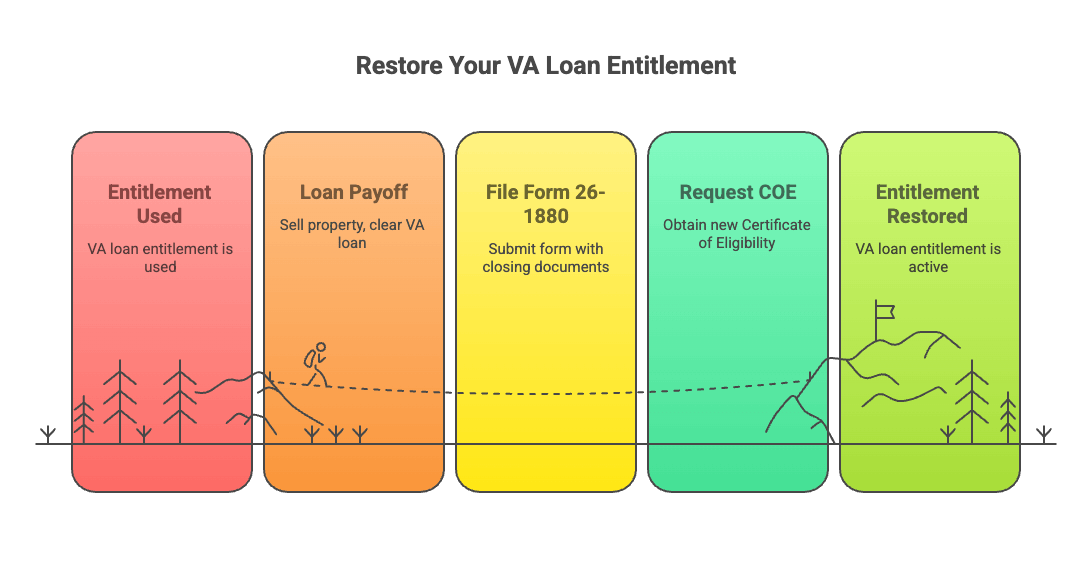

How to Restore Your VA Entitlement: Your Step-by-Step Guide

Ready to get your entitlement back? I've broken it down into three simple steps that won't have you pulling your hair out:

- Sell and clear that VA loan completely. This is non-negotiable—full payoff is your golden ticket to restoration.

- File VA Form 26-1880 with your closing documents. Don't forget to include your HUD-1 settlement statement. Think of it as your receipt proving the job's done.

- Request your new Certificate of Eligibility (COE). This document is your proof that your entitlement is back in action and ready for your next home purchase.

Pro tip: If you're thinking about refinancing to a conventional loan and keeping the property as a rental, you might qualify for a one-time restoration. But remember—this is a once-in-a-lifetime card. Play it wisely.

Buying Again with Your VA Loan: Yes, You Can!

Here's something that surprises a lot of veterans: You can use your VA loan benefit multiple times throughout your life. It's not a one-and-done deal. But there's a catch—your entitlement needs to be restored first.

If your entitlement is still tied up in a previous property, you might need to bring a down payment to the table next time. In 2025, Arizona's VA loan limit sits at $766,550. If your remaining entitlement doesn't cover 25% of your next home's purchase price, you'll need to bridge that gap yourself.

For PCS families, this math matters. A lot. That's why getting your full entitlement restored before you leave Surprise isn't just smart—it's essential for your financial flexibility at your next base.

Cash Offers: The Stress-Free PCS Solution

Let's be real for a minute. When you're juggling household goods shipments, school transfers, medical records, and a million other PCS tasks, the last thing you need is a home sale dragging on for months.

This is where cash offers become your secret weapon. They cut through the red tape like a hot knife through butter—no 30-90 day assumption delays, no nail-biting appraisal drama, and most importantly, your entitlement gets restored fast.

One veteran recently shared on Reddit: "I had 21 days before my report date. Traditional sale? Impossible. Cash offer? Done in a week. Saved my sanity and my entitlement."

With heroSOLD™'s Cash Offer Program, you're not just selling fast—you're selling smart. Days, not months. Certainty, not chaos.

heroSOLD™: Your VA-Savvy Ally in Surprise, AZ

Look, we've been in your boots. We understand that selling during a PCS isn't just another real estate transaction—it's a high-stakes mission with your family's future on the line.

That's why heroSOLD™ does things differently for military families in Surprise. We're not just here to list your home and hope for the best. We're here to:

- Decode your VA entitlement options in plain English—no confusing jargon, just straight answers

- Navigate your PCS sale like seasoned pros who understand military timelines aren't suggestions—they're orders

- Analyze assumptions versus cash offers to ensure you're maximizing both your time and your benefits

- Fast-track your entitlement restoration so your VA loan is locked and loaded for your next home

Need more intel? Check out our PCS VA Home Sale Guide and Luke AFB Real Estate Guide for location-specific strategies.

Feeling Lost About Your VA Loan? We've Got You.

Moving is stressful enough without VA loan confusion adding to the mix. You've served our country—now let us serve you. At heroSOLD™, we cut through the complexity, answer your toughest questions, and transform your Surprise, AZ home sale from mission impossible to mission accomplished.

Let's have a real conversation about your situation and map out your best path forward.

Your Move, Your Benefits—Don't Wait

Every day counts when you're facing a PCS deadline. Your VA entitlement is too valuable to leave hanging in limbo, and your peace of mind is priceless.

heroSOLD™ stands ready as your trusted ally in Surprise, AZ. We help veterans sell with confidence, reclaim their benefits without the runaround, and step boldly into their next adventure. Because you've earned the right to a smooth transition.

Ready to take control of your sale? Start with a free home valuation today. Let's turn your PCS countdown into a success story.

Leave a Reply