Blog > Who Can Assume Your VA Loan When PCSing From Luke AFB?

Who Can Assume Your VA Loan When PCSing From Luke AFB?

Those PCS orders just hit your inbox, and suddenly everything's moving at warp speed. Between coordinating movers, researching schools, and saying goodbye to friends, there's that nagging question about your home near Luke Air Force Base. What if I told you someone could simply take over your VA loan, keeping that sweet 3% rate while you focus on your next mission? It's not just possible—it might be your smartest move in today's market. Let's break down exactly who can assume your loan and how to make it happen without losing sleep.

✅ What's a VA Loan Assumption, Anyway?

Think of a VA loan assumption like passing the keys to your favorite car—except the new driver also takes over your payments and that killer interest rate you locked in years ago. While everyone else is sweating over 7% rates, your buyer slides into your 3% loan like it was made for them. For military families racing against PCS deadlines, this isn't just convenient—it's a game-changer that can shave weeks off your selling timeline.

Here's what actually happens:

- The buyer takes on your exact loan terms—same rate, same monthly payment, just a new name on the paperwork.

- Your lender or the VA gives it the green light (the rules depend on when you first got your loan).

- You pocket any equity you've built up, though your VA entitlement might need to wait for its next assignment.

📌 Who Can Take Over Your VA Loan in 2025?

Not just anyone can waltz in and take over your mortgage. The VA has specific rules about who qualifies, and understanding these can save you from headaches down the road. Here's your complete breakdown:

✅ 1. A Fellow Veteran with VA Benefits

When another veteran steps up with their own VA entitlement, you've hit the jackpot. They take over your loan, and here's the beautiful part—your VA benefit comes back to you, ready for your next home purchase. It's like a perfect military handoff where everyone wins. You get to move on without strings attached, and they score a great rate in a tough market.

✅ 2. A Civilian (Non-Veteran) Buyer

Civilians can absolutely assume your VA loan, but there's more red tape involved. Here's what you need to know:

- They'll face the same credit and income scrutiny as any other buyer—no shortcuts here.

- Without securing a Release of Liability, you're still legally responsible if they stop making payments down the road.

- Your VA entitlement stays locked with that property until the loan's completely paid off—potentially decades.

Pro move: Never, and I mean never, skip the Release of Liability paperwork. It's your insurance policy against someone else's financial mistakes haunting your credit report.

📋 How Does the Assumption Process Work?

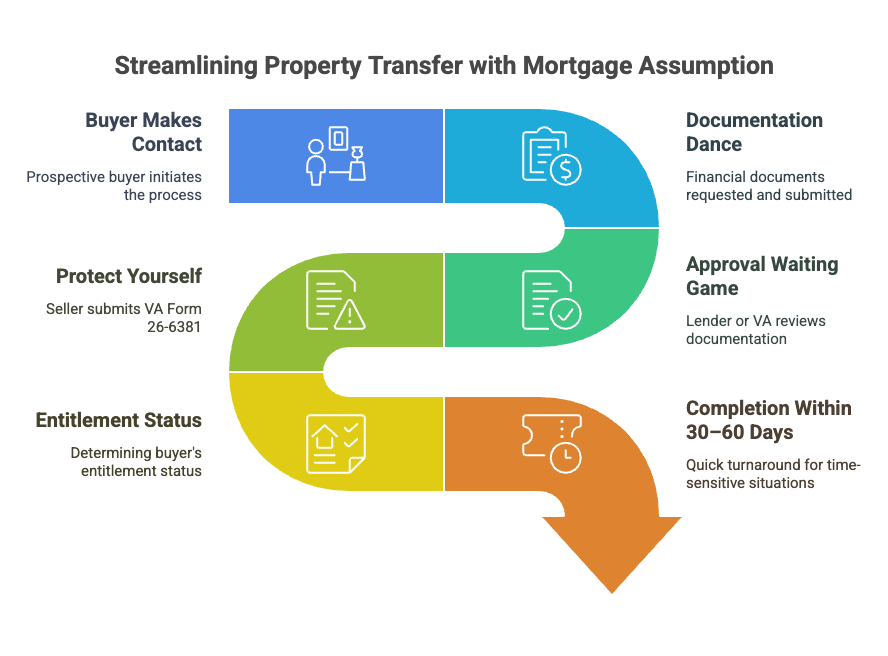

Let's walk through this step-by-step, because knowing the process means controlling your timeline:

- Buyer Makes Contact: They reach out to your loan servicer with their financial information in hand.

- Documentation Dance: Expect requests for pay stubs, tax returns, and bank statements—plus a 0.5% funding fee (some buyers are exempt).

- Approval Waiting Game: Your lender or the VA reviews everything. Simple cases move fast; complex ones need patience.

- Protect Yourself: Submit VA Form 26-6381 to request that crucial Release of Liability.

- Entitlement Status: Veteran buyer? You're golden. Civilian? Your benefit stays put with the property.

Most assumptions close within 30–60 days—music to the ears of anyone with a report date looming.

⚠️ Heads-Up: Risks to Watch For

Every silver lining has its cloud. Here's what could complicate your plans:

- The Entitlement Squeeze: If a non-veteran assumes your loan, that portion of your VA benefit is frozen until they pay it off completely.

- Credit Score Roulette: Skip the Release of Liability, and their missed payment becomes your credit nightmare.

- Clock Management: Some lenders move like molasses. If you're working with a 45-day PCS timeline, communicate early and often.

🎯 When It's the Smart Move

A VA loan assumption makes perfect sense when:

- Your PCS timeline has you feeling the pressure, and traditional selling feels impossible.

- That low interest rate you locked in makes buyers' eyes light up in today's high-rate environment.

- You've built solid equity and want to maximize your buyer pool with this unique selling advantage.

Still weighing your options? Let's map out your best path forward before the moving trucks arrive.

📍 Luke AFB Vibes: 2025–26 Market Snapshot

The neighborhoods around Luke AFB—we're talking Surprise, Glendale, and the surrounding communities—are seeing buyers hungry for creative financing solutions. With mortgage rates hovering in the 7% range, your assumable VA loan at 3% or 4% isn't just attractive—it's magnetic. Local buyers and relocating military families are actively searching for these opportunities, giving you serious negotiating power in what might otherwise feel like a rushed sale.

More resources for your PCS journey:

💰 Simpler Paths: Sell Without the Hassle

Maybe loan assumptions feel too complicated for your situation. That's totally fair—you've got plenty on your plate already. Consider these alternatives:

- Get a cash offer and close on your timeline—no financing delays, no buyer drama.

- Maximize your value with strategic improvements, even with limited time before your move.

🔚 Wrapping Up

Your VA loan assumption could transform a stressful PCS sale into a smooth transition—faster closing, happy buyer, and you're free to focus on what's next. The key is understanding who can assume your loan, protecting your VA benefits, and keeping yourself covered legally. You've handled tougher missions than this, and with the right knowledge, this one's completely doable.

🪖 Ready to tackle your Luke AFB home sale? Connect with a military relocation specialist today. We'll help you navigate every option and find the perfect solution for your timeline. Because your next adventure shouldn't wait on real estate red tape.

Leave a Reply