Blog > Ultimate Guide to Selling a Home with a VA Loan (2025–2026)

Ultimate Guide to Selling a Home with a VA Loan (2025–2026)

PCS orders just landed? I know that feeling—your stomach drops a little, doesn't it? One minute you're settled in, and the next you're staring down a mountain of logistics. New duty station, new schools, figuring out where the commissary is... and oh yeah, you need to sell your house. Fast.

Here's what I want you to know: You've handled tougher missions than this. With the right strategy, selling your home can actually strengthen your position for the next move. You'll protect your VA benefits, maximize your equity, and step into your new assignment with confidence. Whether you're stationed at Luke AFB or anywhere else in Arizona, let's turn this PCS from a scramble into a strategic win.

What Happens When You Sell a Home with a VA Loan?

Selling with a VA loan works like any other sale—until we talk about your VA entitlement. This isn't just another military acronym to memorize. It's your golden ticket to homeownership at every duty station.

Here's how to keep that benefit working for you:

- Pay off the loan at closing: The cleanest path. Your entitlement comes back in full, ready for your next home.

- Veteran assumption: Another vet takes over your loan and swaps their entitlement for yours. Win-win.

- One-time restoration: Already paid off the loan but kept the property? You get one shot to reclaim your entitlement.

Why does this matter? Because your next PCS might drop you in a high-cost area where that $0-down VA loan is the difference between renting and owning. Guard that entitlement like it's your DD-214.

The VA Loan Assumption: A Hidden Gem or a Headache?

Let's talk about the buzziest topic in military real estate right now: VA loan assumptions. Your loan is assumable, which means buyers can take over your sweet 3% rate in today's 6% market. That's like handing them thousands of dollars—and they know it.

Near Luke AFB, where the market moves like a deployment checklist, this can be your ace in the hole. But let's be real about what you're signing up for:

- The good: Buyers flock to low rates. You might get multiple offers just because of that 3% rate.

- The tricky: The paperwork can test your patience. Some folks on X straight-up call it a "nightmare."

- The crucial detail: If a civilian assumes your loan, your entitlement stays locked up until they pay it off. Could be decades.</

My advice? If you're planning to buy at your next station, hunt for a veteran buyer who can swap entitlements. You walk away clean, they get a great rate, everybody wins. Need more details on how this works?

Who Can Assume Your VA Loan Near Luke AFB?

Wondering if an assumption makes sense for your situation? Let's map out your options before those PCS orders get any closer.

Why Your VA Entitlement Is Everything

Think of your VA entitlement as your military housing superpower. It's what lets you buy with zero down while civilians scramble for 20% down payments. But here's what nobody tells you at TAP class—selling affects this benefit in ways that can haunt your next move:

- Full payoff at closing: Your entitlement bounces back, ready for action at your next base.

- Non-veteran takes over: That entitlement sits in limbo until they pay off the loan. Could be 30 years.

- Short sale or foreclosure: This hurts. You might lose the benefit entirely.

I've seen too many families get surprised by this at their next duty station. Picture landing in Surprise or Goodyear, finding your dream home, then discovering your entitlement is tied up in your old place. Don't let that be you.

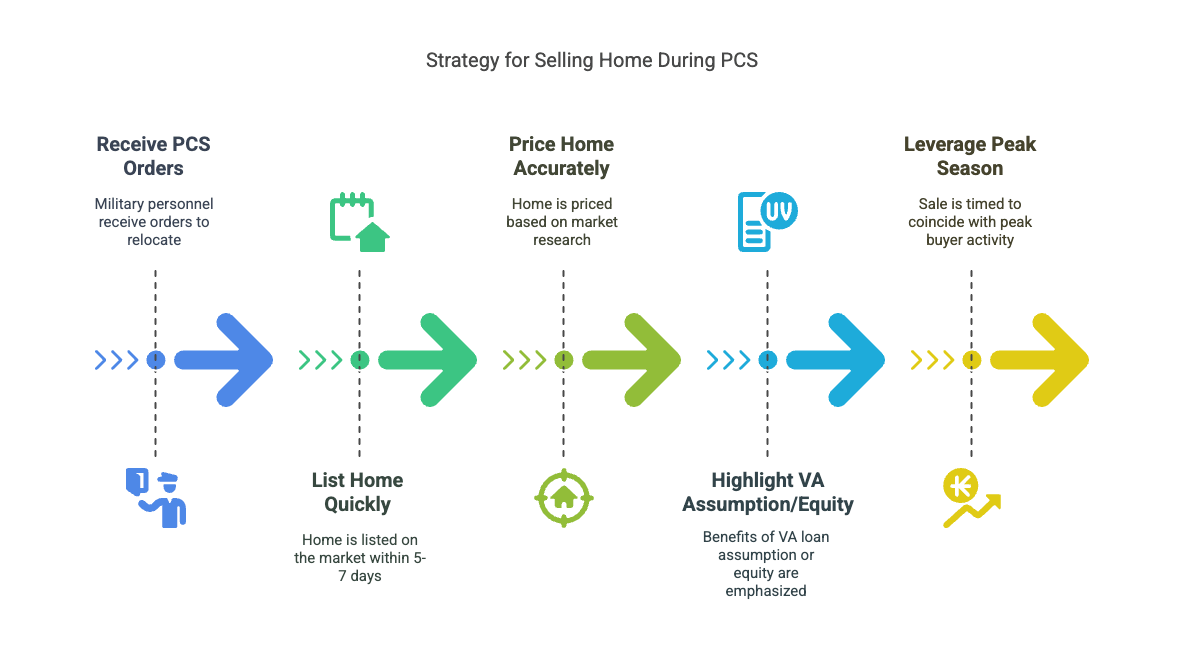

Timing Your Sale: Beat the PCS Clock

PCS math is brutal: 60–120 days to uproot your entire life. Meanwhile, homes in Surprise averaged 60+ days on market in 2025. See the problem? You can't afford to guess wrong here.

After helping dozens of military families navigate this crunch, here's the playbook that works:

- List your home within 5–7 days of getting orders. Yes, that fast.

- Price it right from day one. No time for "testing the market."

- Lead with your VA assumption or equity position—buyers eat this up.

Insider knowledge: Spring through summer near Luke AFB brings peak BAH and maximum buyer activity. If your PCS lines up with this window, you've got an advantage. Use it.

Luke AFB PCS Real Estate Guide

Equity: Your PCS Power Move

That equity you've built? It's not just numbers on paper—it's ammunition for your next chapter. Smart sellers use it to:

- Cover the down payment at your next duty station (especially if your entitlement's tied up)

- Sweeten deals with buyer credits that make offers irresistible

- Bridge appraisal gaps that kill VA buyer deals

Running out of time? Our Cash Offer Program and Fix-to-Sell Program help you capture maximum value without the typical selling stress. Because let's face it—you've got enough on your plate.

Stress-Free Selling: Fast Options for PCS

Got 30 days or less? Traditional selling just became Mission Impossible. But you've got options designed specifically for military timelines:

- Cash Offer: Close in 7–14 days. Done and dusted.

- Fix-to-Sell: We handle repairs, you keep more profit.

- Buy Before You Sell: Secure your next home without the juggling act.

These aren't last resorts—they're strategic choices that keep you in control. Your timeline, your terms.

PCS Panic Setting In? Take a Deep Breath.

You deserve a smooth transition to your next assignment. Let's connect you with someone who speaks fluent military—your acronyms, your timeline, your unique challenges.

Connect With an Agent TodayVA Benefits: Worth the Hype?

Real talk: VA loans come with zero down, no PMI, and rates that make conventional buyers jealous. But scroll through X and you'll see the complaints—strict appraisals, funding fees, endless paperwork. One frustrated user even posted, "VA loans are overrated."

Here's my take after years in this business: Yeah, VA loans have quirks. But for military families? The benefits absolutely demolish the hassles. That zero-down advantage alone can mean the difference between building equity and paying rent at your next station.

Trust the Pros Who Get It

Selling during PCS isn't just about real estate—it's about understanding military life. We know what it's like when orders drop unexpectedly. We understand why protecting your VA benefits matters. We've navigated Arizona markets from Buckeye to Goodyear with families just like yours.

True story: Last month, Sarah (Air Force spouse) got orders with 45 days' notice. We listed her Luke AFB home immediately, found a veteran buyer to assume her loan, and closed in 30 days. Her entitlement? Fully restored for their next base. Her stress level? Way lower than expected.

Your Next Step: A Stress-Free Sale

Listen, I know PCS season feels like drinking from a fire hose. But selling your home doesn't have to add to the chaos. With the right approach, you'll protect your benefits, maximize your return, and actually feel good about this piece of your transition.

Ready to make your move? Let's chat about your specific situation—your timeline, your goals, your concerns. No pressure, just straight talk about your options.

Leave a Reply