Blog > Sell a House During Divorce in Surprise, AZ: Your 2025–2026 Guide

Sell a House During Divorce in Surprise, AZ: Your 2025–2026 Guide

A New Chapter Awaits: Picture this—a Surprise homeowner sits quietly at their kitchen table, divorce papers spread before them. The house that once echoed with shared dreams now feels heavy with memories. If you're searching "sell a house during divorce in Surprise, AZ," you're taking the first brave step toward something better. This isn't just about real estate. It's about reclaiming your life, and we're here to help you through it.

Why Selling a Home During Divorce Feels Overwhelming

Let's be honest—divorce turns everything upside down. Your home becomes ground zero for conflicting emotions. Maybe you're grieving what was. Perhaps you're worried about starting over financially. For military families stationed at Luke AFB, add VA loan complications and potential PCS orders to the mix, and it's enough to make anyone feel paralyzed. But here's what we know after years of helping Surprise homeowners: You can get through this, and faster than you think.

The Emotional Toll and How to Stay Grounded

That four-bedroom house might feel like the last stable thing in your kids' lives. One spouse dreams of keeping it, clinging to familiarity. Reality check: Can you actually afford it solo? Surprise's 2025 market isn't forgiving to single-income households. Too many people fall into the "house rich, cash poor" trap—keeping the home but drowning in mortgage payments while their savings evaporate. Sometimes letting go is the strongest choice you can make.

Arizona's Community Property Laws: What You Need to Know

Here's the deal with Arizona law: If you bought the house together, you can both own it 50/50. Doesn't matter whose name is on the mortgage. This means you need agreement—or a judge's order—to sell. While you're waiting for lawyers to hash it out, Surprise's market continues to shift. Every month of delay could mean thousands less in your pocket. Time isn't neutral in divorce; it has a price tag. Please note that this is based on our being a community property state, where both parties are on title and not necessarily on the mortgage together.

Additionally, disclaimer deeds could have been used, funds could have been commingled, etc. With all this said, we are not lawyers, and this is not legal advice. All legal matters, such as this, should be addressed by lawyers who specialize in divorce.

Three Paths for Divorcing Homeowners

- Sell and Split: The cleanest break. List it, sell it, divide the cash, and both walk away free. Most couples find this path leads to the fastest healing.

- Spouse Buyout: Think you want to keep the house? Better crunch those numbers first. Refinancing means qualifying on one income, plus paying your ex their share. VA loans make this extra complicated.

- Deferred Sale: Courts sometimes let one parent stay until kids finish school. Sounds nice, but you're still financially tied to your ex for years. Recipe for future conflict? Often, yes.

VA Loan Equity and Military Relocation

Luke AFB families face unique challenges. VA entitlements don't split easily in divorce. If you're the veteran spouse, your loan benefits might be locked up until the house sells. Got PCS orders coming? Now you're racing against military timelines AND divorce proceedings. Traditional sales take 30-60 days in today's Surprise market—time you might not have. That's why specialized military relocation programs exist. We get it, and we move at military speed.

Co-Ownership Risks in Divorce

Some couples think they'll stay friends and co-own the house. Noble idea, risky reality. What happens when your ex misses a payment? Your credit tanks too. Need a new roof? Good luck agreeing on contractors and costs. Meanwhile, Surprise's market isn't waiting for you to figure things out. Property values fluctuate, and that equity you're fighting over today might shrink tomorrow. Clean breaks heal faster than messy entanglements.

Surprise, AZ Market in 2025–2026: Why Speed Matters

Real talk about Surprise's market: The gold rush days are over. Homes sit longer. Buyers negotiate harder. Multiple offers? Not so much anymore. If your divorce drags into 2026, you could lose serious equity. Military families know this pressure—PCS deadlines don't care about court dates. Couples relocating for jobs face the same crunch. Every week of indecision costs money. Sometimes a bird in the hand beats two in the bush.

Cash Offers vs. Traditional Sales

Traditional listing means staging, showings, and strangers walking through your emotional battlefield. Cash offers? Different story. No repairs, no open houses, close in 7-10 days. Yes, the price might be lower, but factor in holding costs, market risk, and your sanity. For high-conflict divorces or military moves, that certainty is golden. Want to know what your house is worth either way? Get a no-obligation cash offer and compare your options.

Feeling Stuck? Get Clarity Today

Discover your home's value and explore fast sale options with no pressure. Get Your Free Home Valuation Now

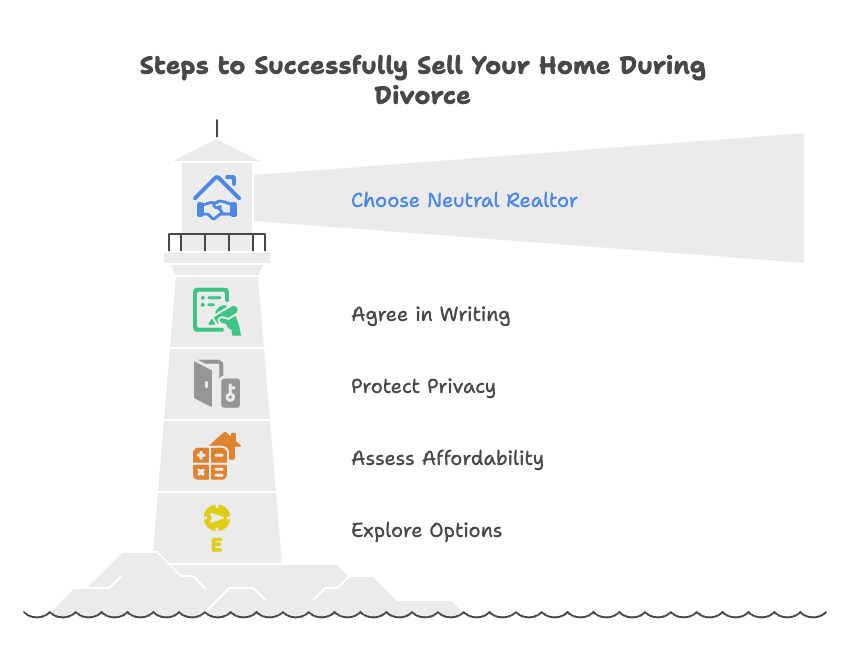

5 Expert Tips for Selling Your Home During Divorce

- Choose a Neutral Realtor: You need someone who won't take sides, just results. Our heroSOLD team keeps communication crystal clear for both parties.

- Agree in Writing: Handshake deals fall apart under stress. Document everything—listing price, repair limits, how you'll split proceeds. Your future self will thank you.

- Protect Your Privacy: Never advertise it as a "divorce sale." Buyers smell blood in the water and lowball accordingly. Keep your business your business.

- Assess Affordability: Love the house? Great. Can you afford it solo? Include property taxes, HOA fees, maintenance, and Surprise's rising utility costs. Be ruthlessly honest.

- Explore All Options: Maybe you need our fix-to-sell program to maximize value. Perhaps a quick cash offer fits better. Knowledge is power—get all your options on the table.

When Courts Get Involved

Can't agree on selling? Welcome to court-ordered sales. Judges don't have patience for stubborn spouses when neither can afford the house solo. They'll appoint mediators or Special Real Estate Commissioners—more people taking cuts of your equity. Legal fees mount. Timelines stretch. Your Surprise home loses value while lawyers argue. Proactive couples who sell early keep more money and skip the courtroom drama entirely.

Why Trust heroSOLD?

We've walked hundreds of Surprise homeowners through life's toughest transitions. Military relocations, sudden divorces, financial crunches—we've seen it all and helped them all. No judgment, just solutions. Our local market knowledge means realistic pricing. Our program options mean flexibility. Most importantly? We treat you like family, not a transaction. Whether you need a lightning-fast cash offer or a strategic market valuation, we've got your back.

Start Your Next Chapter Today

Selling during divorce isn't just a financial decision—it's an act of self-care. Every day you stay stuck costs more than money. It costs peace of mind. Surprise's market won't wait for your divorce to finalize. Your fresh start shouldn't either. Take control now, protect your equity, and build the future you deserve. The house is just walls and a roof. Your life? That's worth fighting for.

Ready for a Stress-Free Sale?

Get a no-obligation home valuation and explore fast, fair options tailored to your needs. Get Your Free Home Value Report Today!

Leave a Reply