Blog > Rent or Sell Before PCS? Luke AFB Homeowners' 2025 Guide

Rent or Sell? What Luke AFB Homeowners Should Know Before Your PCS

Your PCS orders just dropped. Get the tactical playbook for maximizing your home's value—built from real Luke AFB sales data.

Get Your Free Home Value ReportYour PCS orders just dropped. That familiar cocktail of excitement and stress hits all at once—new adventures ahead, fresh opportunities waiting, but also that heavy question weighing on your mind: What happens to your home?

I've guided hundreds of military families through this exact crossroads. You're not just making a real estate decision here—you're choosing between immediate financial freedom and long-term wealth-building potential. Between the peace of mind that comes with a clean slate and the calculated risk of building an investment portfolio.

This isn't some cookie-cutter advice you'll find on generic real estate blogs. This is your tactical playbook, built from real Luke AFB sales data and crafted specifically for military homeowners who refuse to leave money on the table during one of life's biggest transitions.

Trusted by Luke AFB Military Families

Should You Rent or Sell Before Your Luke AFB PCS?

Here's the unvarnished truth: There's no magic formula that works for every military family. But there absolutely is a right answer for your unique situation.

Your decision comes down to three mission-critical factors: your current financial position, your long-term goals, and—let's be honest—how much stress you can realistically handle while serving your country with excellence.

Selling: Your Clean Break Strategy

When you sell, you walk away with cash in hand and zero Arizona real estate headaches trailing behind you. No more surprise property tax bills. No more frantic 3 AM phone calls about broken water heaters. No tenant drama while you're stationed in Germany or Korea, trying to focus on your mission.

🎯 Key Benefit: Selling frees up your VA loan benefits—crucial if you're planning to buy at your next duty station.

Renting: The Wealth-Building Gamble

Keep the house, and you're essentially betting on Arizona's continued growth story. The Phoenix metro isn't slowing down—that much is clear. But neither are the responsibilities and headaches that come with being a landlord from 2,000 miles away.

⚠️ Reality Check: Every successful military landlord has war stories that would make you think twice.

Need a Quick Cash Offer?

Explore your options with our no-obligation cash offer program.

Request Your Cash Offer NowThe Financial Reality: Net Proceeds vs. Cash Flow

Let's cut through the speculation and get down to hard numbers. Here's what a typical $450,000 Surprise home looks like in today's market:

✅ If You Sell Today: Your Net Cash Position

That's real money sitting in your account. Debt elimination money. Down payment money for your next duty station.

⚠️ If You Rent: The Monthly Reality Check

Market rent looks appealing at approximately $2,200 per month. But that number loses its shine once you factor in the hidden costs:

Translation: You'd be writing a check for $536 every single month to own rental property. That's $6,432 annually.

PCS Orders Creating Deadline Pressure?

Get clarity on your home's real value and exit options.

No-Pressure Consultation. Real Numbers. Military-Focused Solutions. Start Here »The Emotional Reality: Stress vs. Simplicity

Property management companies promise the world during their sales pitch. But when your tenant's water heater fails on Christmas morning, guess whose phone rings? When they decide to stop paying rent during your deployment, guess who's stuck handling an eviction from overseas?

I've watched too many dedicated military families turn their dream investment into a financial nightmare because they underestimated the emotional toll of long-distance landlording while serving our country.

Selling gives you something invaluable in military life: closure. Clean books. Clear conscience. Complete focus on your military career and family without property management distractions pulling you away from your mission.

Your VA Loan: Strategic Weapon or Limiting Factor?

Your VA loan creates unique advantages—and potential constraints that civilian homeowners never face:

✅ Sell and Leverage It:

Your assumable low-rate loan becomes a major competitive advantage. Buyers are literally fighting for 3.5% interest rates in today's market.

⚠️ Rent and Tie It Up:

Your VA entitlement stays locked to this property, potentially limiting your purchasing power when you reach your next duty station.

Before you make this decision, make sure you understand exactly who can assume your VA loan at Luke AFB and how it impacts your future home buying power.

Military Tax Benefits: The Section 121 Advantage

Here's where military families get a significant edge over civilian homeowners: The Section 121 exclusion can save you thousands in capital gains taxes—even if you're no longer living in the home when you sell. (We are not CPAs nor lawyers, so this is not advice, so seek the right legal advice.)

⚡ But this powerful benefit comes with timing restrictions. Rent too long, and you could lose this tax advantage permanently. We're talking about potentially $10,000+ in unnecessary taxes—money that belongs in your family's pocket, not Uncle Sam's.

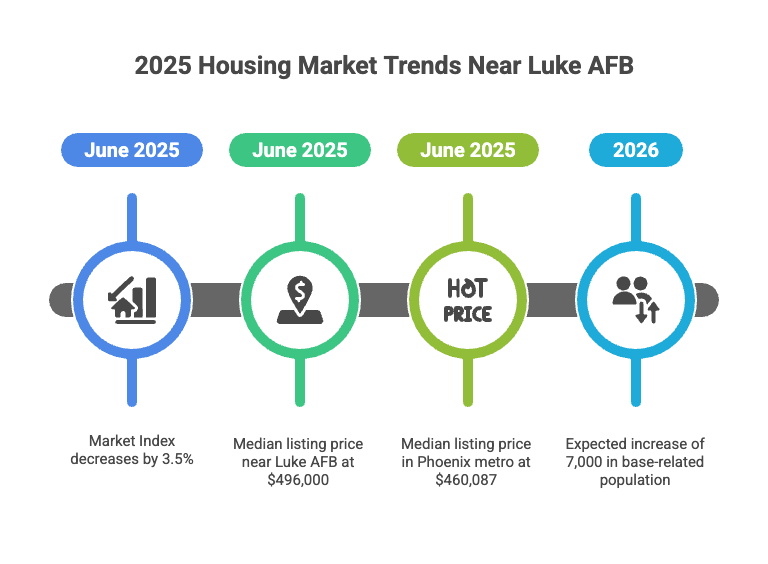

2025 Market Reality: Still Strong, But Shifting

The Luke AFB area remains one of Phoenix's most stable and desirable markets. However, inventory is climbing steadily, and homes are taking longer to sell than they did during the 2022-2023 frenzy.

🎯 What this means for you: If selling is your choice, sooner beats later every time. Your equity sits at historic highs right now, but competition increases with every month that passes.

Decision Framework: Which Path Matches Your Mission?

✅ Sell If You Value:

⚠️ Consider Renting If You Have:

Your Next Move: Get Real Numbers, Not Estimates

Every home, every mortgage, every family situation tells a different story. Don't make a quarter-million-dollar decision based on generic online advice or calculator estimates.

You deserve a professional analysis that shows you exactly what your home is worth today, what you'd net from a sale, and what rental income you could realistically expect—with all the hidden costs factored in.

PCS Timeline Ticking?

Get your personalized exit strategy analysis.

Free Home Evaluation + Military-Specific Selling Options. No Pressure, Just Facts »Essential Resources for Luke AFB Military Sellers

Ready to Make Your Move?

Get your personalized Luke AFB home selling strategy today.

Licensed real estate professionals. Equal Housing Opportunity. All information deemed reliable but not guaranteed. Buyers should conduct their own investigation and consult with qualified professionals. heroSOLD™ is committed to providing exceptional service to all military families and veterans. This content is for informational purposes and does not constitute legal, financial, or real estate advice.

Leave a Reply